By Daniel G. Chung[1]; Connor M. McGregor[2], of Finnegan LLP

It is an exciting time for golf. Despite having only 250:1 odds prior to the 2021 PGA Championship, Phil Mickelson became the oldest player to win a major at the age of 50. At the 2021 U.S. Open, Jon Rahm won his first major only weeks after being pulled from the Memorial Tournament (where he had a six-shot lead on day three and was likely to win) for a positive COVID-19 test. Like Mickelson and Rahm, the golf industry has shown a knack for a comeback. Although golf participation dipped following the 2008 financial crisis, golf’s popularity has since experienced steady growth in recent years, including a surge in participation during the COVID-19 pandemic. As the $84 billion golf industry focuses on maintaining this trend and continuing to grow the game, product innovation and technology continue to play an ever-increasing role. From new golf balls and clubs to shot trackers, swing analyzers, and other training aids, the technology surrounding golf is helping players of all skill levels and driving consumer demand. To complement innovation and product development, golf companies have made significant efforts to protect and enforce the related intellectual property (IP). The following snapshot highlights the trends, technologies, and issues from these recent IP efforts, while providing some takeaways as golf companies continue to innovate and keep pace with the growing market.

U.S. Patent Filing Trends

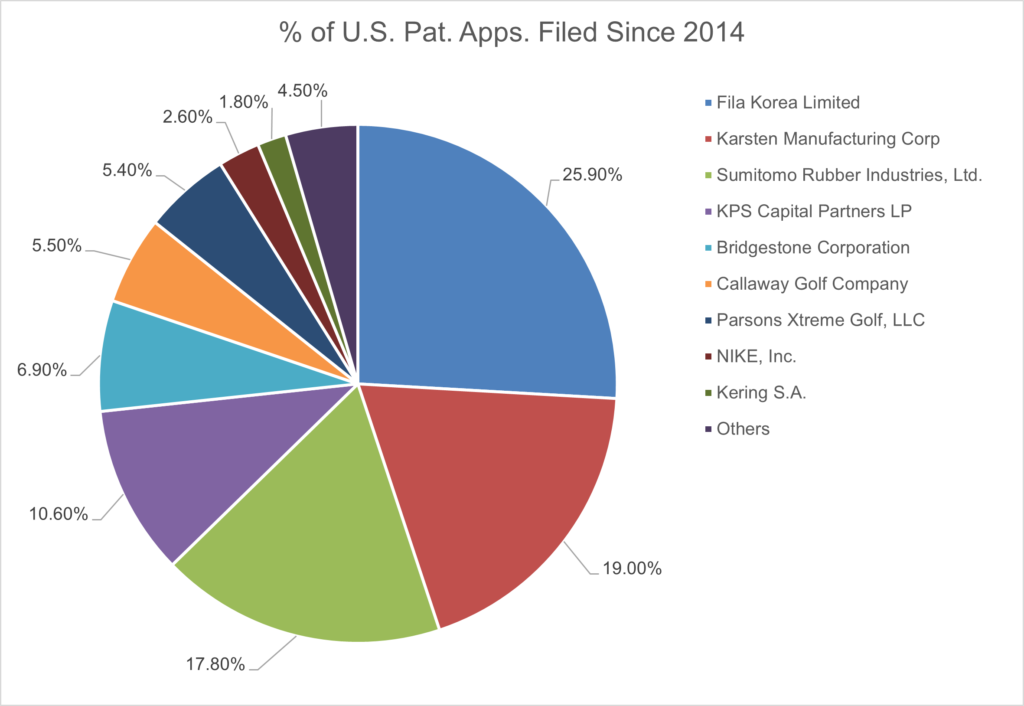

Since 2014, companies and individual inventors have filed U.S. patent applications for a diverse array of golf-related technology.[3] Two technical categories, however, clearly top the list: (1) golf club technology with over 2,200 patent application filings and (2) golf ball technology with over 1,000 patent application filings.[4] As shown below, seven companies have filed over 90% of these patent applications.[5]

Not surprisingly, these companies represent some of the most popular brands in the sport—Fila Korea Limited S.A. (which owns Acushnet and Titleist); Karsten Manufacturing Corporation (which owns PING); Sumitomo Rubber Industries Ltd. (which owns Cleveland Golf, XXIO, and Srixon); KPS Capital Partners LP (which owned TaylorMade prior to its recent sale to Centroid Investment Partners); Bridgestone Corporation; Callaway Golf Company; and Parsons Xtreme Golf, LLC (“PXG”).

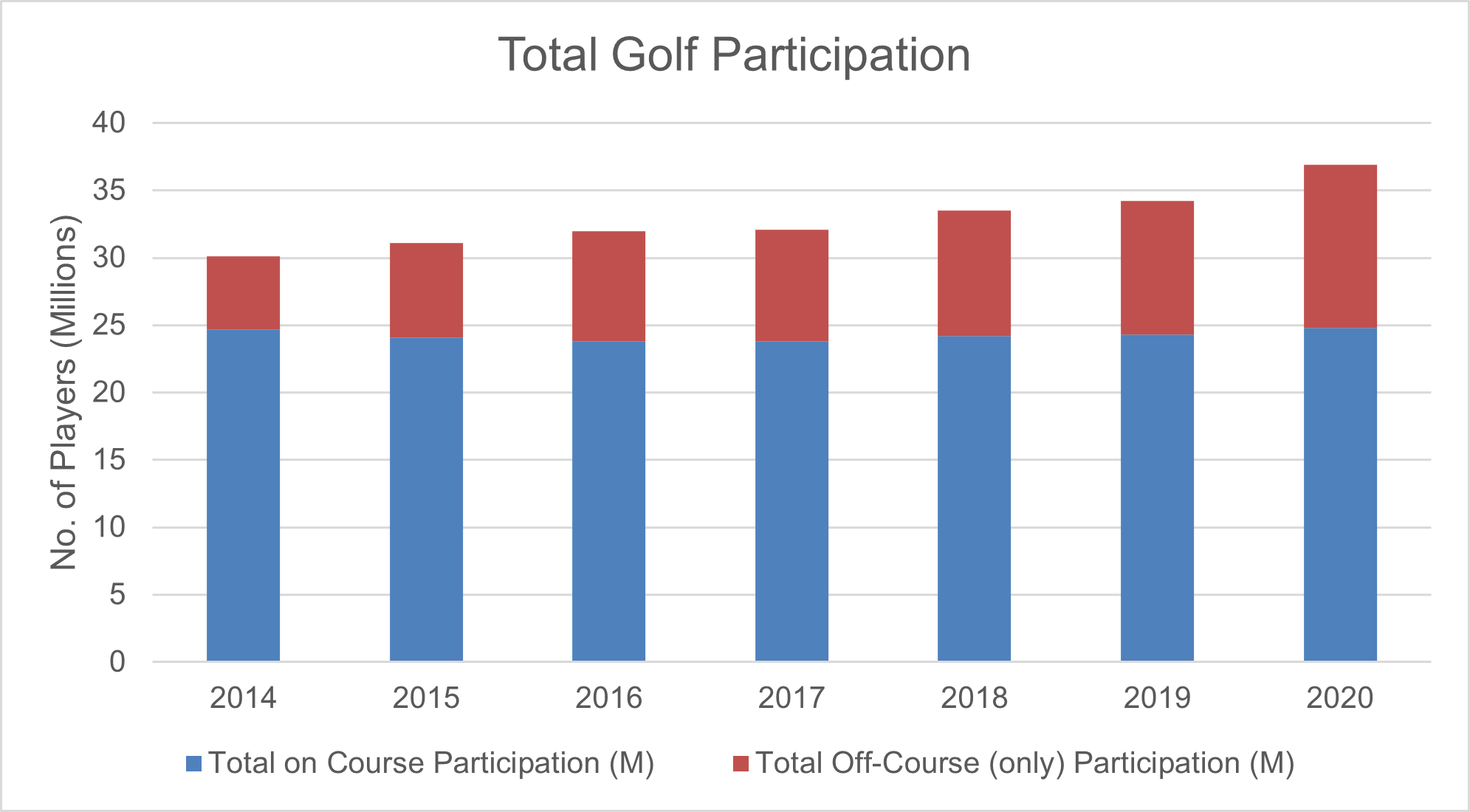

When analyzing the data, the recent growth in golf’s popularity can also be attributed to off-course participation. The National Golf Foundation’s (“NGF”) golf industry reports account for off-course participants, which are players that did not play at traditional golf courses but at golf entertainment venues, indoor golf simulators, and/or driving ranges.[6] As shown by NGF’s data below, the trend in off-course participation has been positive since 2014.

Companies in the golf industry have advanced IP strategies that coincide with the growing popularity in off-course participation. For example, while many golf-related U.S. patent application filings involve technologies in more traditional products, such as golf balls and golf clubs, technologies for off-course participation have also been in the top ten for golf-related U.S. patent application filings since 2014. These patent applications, which the U.S. Patent and Trademark Office classifies into particular technical categories, include detection, measuring or recording technology, training appliances, and video games.[7]

Snapshot of IP Disputes

As the market continues to grow and competition becomes tighter, players in the golf industry have taken action to enforce and defend their IP rights. And many of these IP disputes involve product features and technologies that drive consumer demand and golf’s rising popularity.

Disputes have been filed in U.S. district courts and the Patent Trial and Appeal Board at the U.S. Patent and Trademark Office. For example, over 35 disputes involving U.S. patents in the golf club or golf ball classifications have been initiated since 2014.[8] The majority of those disputes have involved PXG and/or TaylorMade. Notably, in 2017, PXG filed a complaint against TaylorMade in the U.S. District Court for the District of Arizona, alleging patent infringement of eight patents relating to golf clubs “with an expanded sweet spot, having an ultra-thin club face, and an elastic polymer material injected in the hollow-bodied club head.”[9] TaylorMade counterclaimed with patent infringement allegations of its own, and both parties filed numerous challenges at the U.S. Patent and Trademark Office, seeking to invalidate the other party’s asserted patents. The parties eventually settled, and although the terms of the settlement were not disclosed, a PXG press release reports that the two companies “will have specified rights to make club products under patent cross-licenses.” PXG’s CEO further stated that “as a golf equipment innovator, PXG will continue to pursue research and development and obtain patents for our novel club designs in the iron technology space. We will not hesitate to assert those patents in the future.”[10] Keeping their word, PXG filed another suit against Southern California Design Company d/b/a Indi Golf in the U.S. District Court for the Southern District of California, alleging patent infringement of four patents for golf club heads.[11] The parties settled, and PXG voluntarily dismissed the case in October, 2021.

Disputes have also involved non-traditional players in the golf equipment market. For example, in 2017, Costco Wholesale Corporation faced off against golf industry heavyweight Acushnet Company in a pair of IP suits in the U.S. District Court for the District of Western Washington.[12] Acushnet alleged, among other claims, that Costco’s Kirkland Signature golf ball infringed ten Acushnet patents, and Costco filed its own suit seeking a declaration that the Acushnet patents were not infringed and are invalid. The parties settled in 2018.

In addition, recent U.S. patent disputes have involved technologies that complement the growing off-course participation in golf. For example, in 2016, Amit Agarwal sued Topgolf in the U.S. District Court for the Middle District of Florida, alleging infringement of a patent directed to a method for playing a point-scoring game at a golfing range.[13] In response, Topgolf successfully challenged the validity of the asserted patent at the U.S. Patent and Trademark Office, which was affirmed on appeal.

Takeaways

This IP snapshot of the golf industry provides several takeaways. Technology is expanding the golf equipment umbrella and is also changing how people play the sport. And naturally, golf companies are adapting to the expanding consumer demands on and off the course. As innovations are developed, it is important to have a strategy ready to protect them. Indeed, the most successful brands in the sport have the largest patent portfolios. This allows them to utilize their IP offensively, such as enforcing patents against alleged infringers, and for defensive purposes, such as countersuing for patent infringement, gaining leverage in an existing dispute, or acting as a deterrent against potential competitors. The resolution of the patent dispute between PXG and TaylorMade, which ended in a cross-licensing agreement, is a good example of how their respective portfolios were used for these offensive and defensive purposes.

Moreover, the expanding forms of technology and the players under the golf equipment and entertainment umbrella highlight the value of freedom-to-operate analyses. As the industry becomes more popular and diverse, navigating the potential IP infringement risk and enforcement opportunities will help a company make business and legal decisions as it develops and produces new golf products to meet the growing demand from both the traditional and non-traditional golf consumer.

IP due diligence and freedom-to-operate analyses should also be considered in other relevant contexts. Golf companies often acquire other companies to expand and/or diversify their market and product lines. An example of this is the 2020 merger between Callaway and Topgolf. At the time, the companies touted that they are “highly complementary businesses with reach across the entire $80 Billion global golf industry” and “together, Callaway and Topgolf create an unrivaled golf and entertainment business” and will “strengthen the experiences we create at the intersection of sports and tech-driven entertainment.”[14] The merger was complete a few months after Topgolf’s patent dispute discussed above was resolved in its favor. This example stresses the significance of analyzing IP issues to assess the risk and valuation for such transactions before and after closing.

As the golf industry continues its comeback and grows in popularity, innovation and product development will serve as major tools to capture the traditional and non-traditional golf consumer. And as golf companies continue to innovate, a recent snapshot of the industry highlights the importance of protecting their IP, assessing IP-related risks and opportunities, and taking action against other IP threats.

[1] Daniel is a partner at Finnegan LLP, one of the world’s leading intellectual property law firms. Daniel is also a co-leader of the firm’s Sports, Fitness, and Outdoor Recreation industry group.

[2] Connor is an associate at Finnegan LLP, and a member of the firm’s Sports, Fitness, and Outdoor Recreation industry group.

[3] U.S. patent statistics come from reports generated by Innography (Innography is a trademark of Clarivate and its affiliated companies). Innography: keyword search for “golf” in U.S. patent applications filed since 2014.

[4] Innography: keyword search for “golf” in U.S. patent applications filed since 2014, and classified by the U.S. Patent and Trademark Office under Cooperative Patent Classification (CPC) Classes A63 B53/00:Golf Clubs and A63 B37/00:Balls.

[5] Innography: search results broken down by U.S. patent application assignee or applicant.

[6] National Golf Foundation. https://www.thengfq.com/2019/04/ngf-releases-2019-golf-industry-report/; https://www.thengfq.com/2020/04/2020-golf-industry-report-available-to-members/.

[7] Innography: keyword search for “golf” in U.S. patent applications filed since 2014, and classified under CPC Classes A61 B5/00:Detecting, Measuring or Recording for Diagnostic Purposes; A63 B69/00:Training Appliances or Apparatus for Special Sports; A63 F13/00:Video Games.

[8] Innography: keyword search for “golf” in U.S. patent litigations filed since 2014.

[9] Complaint at pg. 2, Parsons Xtreme Golf, LLC v. TaylorMade Golf Co. Inc., No. 17-03125 (D. Ariz. Sept. 12, 2017).

[10] Parson Xtreme Golf, LLC. https://www.pxg.com/en-us/about/news/pxg-and-taylormade-golf-company-jointly-announce-s.

[11] Complaint, Parsons Xtreme Golf, LLC v. S. Cal. Design Co., No. 21-cv-1275 (S. D. Cal. July 15, 2021).

[12] Costco Wholesale Corp. v. Acushnet Co., No. 17-00423 (W.D. Wash. Mar. 17, 2017); Acushnet Co. v. Costco Wholesale Corp., No. 17-01214 (W.D. Wash. Aug. 10, 2017).

[13] Agarwal v. Topgolf Int’l, Inc., No. 16-02641 (M.D. Fla. Sept. 14, 2016).

[14] Topgolf International, Inc. https://press.topgolf.com/2020-10-27-Callaway-and-Topgolf-to-Combine-Creating-a-Global-Golf-and-Entertainment-Leader.