By Daniel G. Chung and Christopher C. Howes, of Finnegan

The water sports industry has had steady wind in its sails, and that breeze might be picking up. Market analysts expect the global recreational boat market and water sports equipment market to reach $54.9 billion and $55.2 billion, respectively, by 2027.[1] Like many other industries, the water sports industry has and continues to feel the impacts of COVID-19. But with the pandemic, the industry has also enjoyed a surge in consumer demand for outdoor recreational activities and products, resulting in, for example, an 8% increase in sales of personal watercrafts, a 20% increase in sales of wake boats, and a 12% increase in sales of freshwater fishing boats and pontoon boats in 2020.[2] In fact, U.S. boat sales reached a 13-year high in 2020[3], sales numbers the industry had not seen since before the 2008 financial crisis. And the upward trend is not limited to watercrafts. The industry has also benefited in an uptick in sales of water sports equipment, ranging from clothing, swim fins, swim masks and goggles, buoyancy control devices, watches, life jackets, safety helmets, and other related products.[4]

Along with the pandemic-driven demand, various other factors have contributed to the recent growth in the U.S. water sports industry. For example, the industry experienced a spike in new boat buyers, increasing for the first time in a decade to about 100,000 consumers. In addition, the industry has expanded the services available for consumers to experience the open waters without the expense and responsibility of boat ownership. These include boat subscription services that charge membership fees for access to fleets of boats and other platforms that seamlessly allow boat owners to rent their boats to consumers. Whether driven by first-time boat ownership or expanding alternative services to boat ownership, product innovation and technology development continue to play an ever-increasing role in the market’s significant rise. Indeed, a wide variety of technologies have been implemented to ease boat operation, and in turn encourage participation and increase the consumer base. A small sampling of these technologies include remote start, joystick control, automatic docking, and connected technologies that provide the ability to remotely monitor a boat’s data (battery, fuel level, etc.) on a smart phone.[5] And other technologies and innovative products surrounding water sports, from paddle boards and hydrofoils to wake forming systems, are helping participants with a wide variety of interests enjoy their time in the water and driving consumer demand.

As water sports companies innovate and develop new products to satisfy the booming demand, significant efforts have been made to protect and enforce the related intellectual property (IP). The following snapshot highlights the trends, technologies, and issues from these recent IP efforts, while providing some takeaways as water sports companies continue to innovate and keep pace with the growing market.

U.S. Patent Filing Trends

Since 2015, companies and individual inventors have filed U.S. patent applications for a diverse array of water sports-related technology. Three technical categories, however, appear to clearly top the list: (1) swimming or pool related products with over 180 patent application filings, (2) hydrodynamic features of hulls or hydrofoils with over 120 patent application filings, and (3) outdoor propulsion units with over 100 patent application filings. Other technical areas in which water sports companies are actively seeking patent protection include water sports or leisure vessels, water sports boards, swimming aids, fishing equipment, buoys, and vessel parts and accessories.[6]

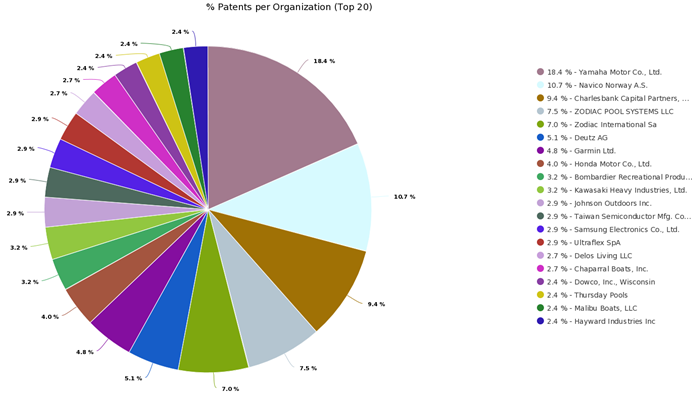

As shown below, many different entities have been seeking U.S. patent protection for their innovations related to water sports technology.[7]

Not surprisingly, these entities include some of the most well-known names in water sports, including Yamaha Motor Company, Charlesbank Capital Partners, LLC (which acquired MasterCraft Boat Company, LLC in 2007[8]), Kawasaki Heavy Industries, and Malibu Boats. The most active entities, however, appear to be Yamaha Motor, Navico, and MasterCraft, with over 144 U.S. patent application filings since 2015.

Naturally, U.S. patent application filings by these entities involve traditional technologies directed to the design of watercrafts and watercraft accessories, such as, for example, deployable platforms for the rear of the watercraft, devices that modify the wake behind watercrafts for various water sports, and watercraft navigation systems for detecting hazards.[9] This is not to say that innovations in the industry are limited to the traditional aspects of boat and watercraft hulls. Water sports companies have also sought patent protection on technologies encompassing various connected technologies to enhance the consumers’ water sports experience. For example, Navico was granted a U.S. patent for an “integrated display for a trolling motor” that can display relevant marine data to the operator in the main housing or foot pedal housing of the motor assembly.[10] As another example, Zodiac Pool Systems has sought patent protection for an “aerial delivery of chemicals for swimming pools and spas” that utilizes unmanned autonomous vehicles to dispense chemicals.[11] As companies expend considerable resources on product development to keep pace with growing consumer demand, the technologies—and patent protection efforts—falling under the umbrella of the water sports industry will continue to increase in diversity and be integrated with advancements in other industries.

Snapshot of IP Disputes

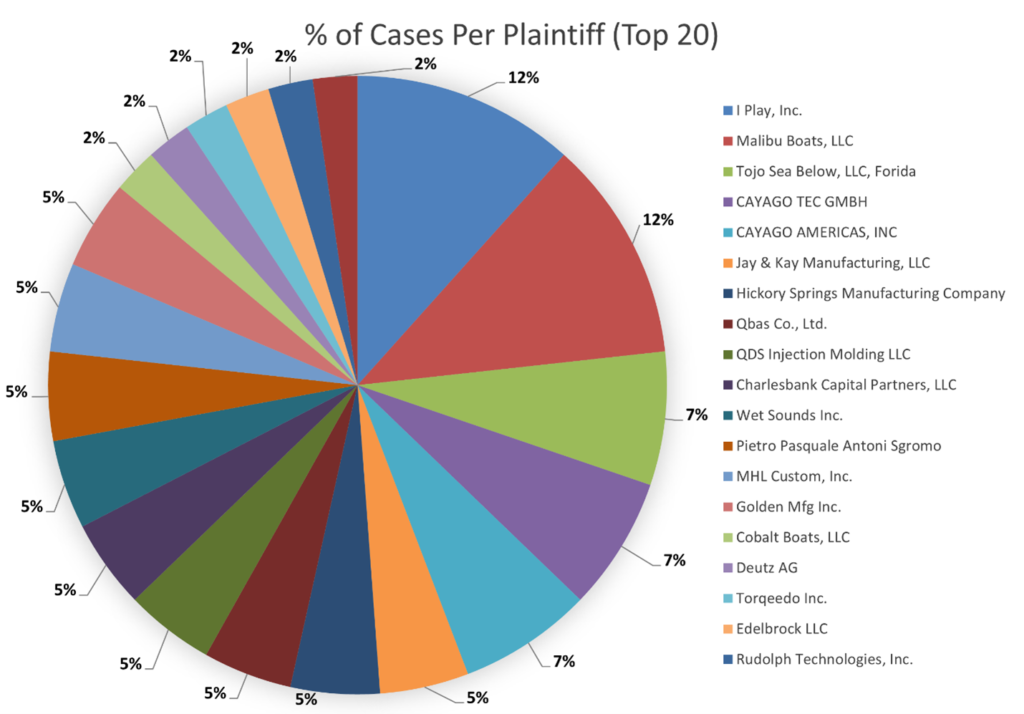

With robust market growth and tighter competition, companies in the water sports industry have taken action to enforce and defend their IP rights. One might expect that the companies most active in seeking patent protection would also be the most active in patent enforcement. As indicated by the chart below, however, that does not always appear to be the case.[12] For example, since 2015, one of the most active plaintiffs in U.S. patent disputes appears to be i play. i play, recently rebranded as Green Sprouts, is a “leading international baby product and lifestyle brand” and has filed five patent infringement suits since 2015, alleging infringement of its U.S. Patent No. 7,678,094 relating to reusable swim diapers.[13]

One company that does appear to be one of the most active in both seeking and enforcing U.S. patents is Malibu Boats. Since 2015, Malibu Boats has filed five patent infringement suits against three different defendants and defended the validity of one of its patent in two Inter Partes Review proceedings at the U.S. Patent and Trademark Office.[14] According to Malibu Boats, the nature of the patented technology involves, for example, “revolutionary wake surf technology” that “modifies the wake formed by a boat travelling through water, which, in part, creates a better-quality surf wake and enables users to surf on either side of the boat’s wake at the push of a button.”[15] To complement its IP portfolio development and enforcement strategies, Malibu Boats has also been active in monetizing its IP through various transactions. Malibu Boat’s CEO has indicated that the company has licensed its IP to more than 20 boating brands, including MasterCraft, Nautique Boat Company, Chaparral Boats, and Tige Boats.[16]

Like the innovations encompassed by recent water sports patent application filings, the technologies involved in recent patent disputes in the water sports industry have also been diverse in scope. These technologies have spanned from watercrafts to rechargeable batteries and even to swimming materials. For example, MHL Custom, Inc. filed patent infringement suits against Avante Innovations, LLC in August 2020, and Waydoo USA, Inc. and Shenzhen Waydoo Intelligence Technology Co., Ltd. in January 2021.[17] The patents-in-suit are entitled “Powered Hydrofoil Board” and “Weight-Shift Controlled Personal Hydrofoil Watercraft” and involve personal hydrofoil watercrafts connected with a propulsion system.

Other examples include Cayago’s suit against iAqua Distribution LLC in 2019, asserting, among other things, patent infringement based on iAqua’s alleged sales and offers to sell “self-propelled watercraft vehicles with rechargeable batteries.”[18] The patents-in-suit are entitled “Rechargeable Battery Unit for a Watercraft” and “Watercraft Comprising a Redundant Energy Accumulator” and involve personal watercraft technology, commonly referred to as an underwater scooter, that partially supports the user’s upper body and allows for traveling on the surface of water and underwater. And in 2015, QBAS Co. Ltd., a “market leader[] in diving and snorkeling products in the U.S. and around the world,” filed suit against Sport Dimensions, Inc. and Body Glove International, LLC, asserting patent infringement relating to dive masks and a splash guard for a snorkel.[19]

Takeaways

Recent trends demonstrate that the water sports industry is expected to maintain its growth trajectory, and as a result, companies will continue to invest in IP protection and enforcement strategies to complement their innovation and product development efforts. Building a robust IP portfolio positions these companies to strategically utilize their IP to fit and advance their business needs as the market and competition grow. From an offensive perspective, companies may consider enforcing their IP against alleged infringers or monetizing their IP through licensing programs. And from a defensive perspective, the IP can be leveraged in an anticipated or existing dispute or simply deter potential competitors from entering the field.

The evolving technology, expanding marketplace, and growing competition of the water sports industry also stress the importance of assessing the potential IP infringement risks and enforcement opportunities. These analyses are valuable for effectively executing business and legal decisions to meet the growing demand of water sports consumers, particularly, for example, when a company and/or its competitors expand and diversify their product lines. Furthermore, other business strategies will require IP due diligence and freedom-to-operate considerations. This includes, for example, acquisition and collaboration opportunities. Brunswick’s recent acquisition activity—the acquisition of Freedom Boat Club, the largest boat club operator that provides a service for paying members to have access to fleets of boats, and Brunswick’s recent announcement of its plan to acquire Navico, a provider of marine electronics, for $1.05 billion[20]—emphasizes the significance of analyzing IP issues in assessing the risks and valuation of a potential acquisition opportunity.

Innovation and product development will continue to serve as key components in capturing the ever-increasing pool of consumers in the water sports industry. This recent snapshot of the industry highlights for water sports companies the importance of protecting their IP, assessing IP-related risks and opportunities, and taking action against other IP threats.

[1] Khushal Bombe, Recreational Boats Market to Reach $54.9 billion by 2027, Growing at a CAGR of 7.8% from 2020 with COVID-19 Impact – Meticulous Research ® Analysis, PR Newswire (Mar. 31, 2021, 08:30 ET), https://www.prnewswire.com/news-releases/recreational-boats-market-to-reach-54-9-billion-by-2027–growing-at-a-cagr-of-7-8-from-2020-with-covid-19-impact—meticulous-research-analysis-301259454.html; Laura Wood, $55.2 Billion Worldwide Water Sports Gear Industry to 2027 – Rapid Growth of Online Retail Platforms Present Opportunities, PR Newswire (Jul. 23, 2020), https://www.prnewswire.com/news-releases/55-2-billion-worldwide-water-sports-gear-industry-to-2027—rapid-growth-of-online-retail-platforms-present-opportunities-301098739.html.

[2] U.S. Boat Sales Reached 13-Year High in 2020, Recreational Boating Boom to Continue through 2021, National Marine Manufacturers Association (Jan. 6, 2021), https://www.nmma.org/press/article/23527.

[3] Broken down further, the U.S. boating industry saw a total retail expenditure of $49.37 billion with 318,600 new boat sales and 1,048,500 used boat sales in 2020. See CNBC, Why U.S. Boat Sales Are Booming, YouTube (Jul. 28, 2021), https://www.youtube.com/watch?v=hspyvIehlxs (citing statistics from the National Marine manufacturers Association).

[4] Roshan Deshmukh Priya, Report Overview: Water Sports Gear Market by Product Type (Water sports Clothes, Wim Fins, Swim Mask & Goggles, BCD {Buoyancy Control Device}, Watches, Life Jackets, Safety Helmets, and Others), Age Group (Kids, Adults, and Geriatric ), and Distribution Channel (Specialty Store, Franchise Store, Online Store, Supermarket/Hypermarket, and Others): Global Opportunity Analysis And Industry Forecast, 2020–2027, Allied Market Research (May 2020), https://www.alliedmarketresearch.com/water-sports-gear-market-A06301.

[5] See CNBC, supra note 3 (citing statistics from the National Marine Manufacturers Association).

[6] U.S. patent statistics come from reports generated by Innography (Innography is a trademark of Clarivate and its affiliated companies). Innography: keyword search for “scuba,” “watercraft,” “boat,” “surf board,” “paddle board,” “wetsuit,” “kayak,” “snorkel,” “wake board,” “swim,” or “personal watercraft” and excluding “car” in the abstract of U.S. patent applications filed since January 1, 2015, and organizing results by Cooperative Patent Classifications (CPCs). Results included CPCs of Swimming or Splash Bath or Pools (E04 H4), Hydrodynamic or Hydrostatic Features of Hulls or of Hydrofoils (B63 B1), Accessories for Angling (A01 K97), Water Sports Boards (B63 B32), Vessels Specially Adapted for Water Sports or Leisure; Body-supporting Devices Specially Adapted for Water Sports or Leisure (B63 B34), Outboard Propulsion Units (B63 H20), and Sports Game Amusements: Swimming (A63 B31).

[7] Id. (organizing results by Organization).

[8] Maura M. Turner, Charlesbank Capital Partners and Transportation Resource Partners Acquire MasterCraft Boat Company, Intrado GlobeNewswire (Oct. 4, 2007), https://www.globenewswire.com/news-release/2007/10/04/1109335/0/en/Charlesbank-Capital-Partners-and-Transportation-Resource-Partners-Acquire-MasterCraft-Boat-Company.html.

[9] See U.S. Patent No. 10,703,446; U.S. Patent No. 9,174,703; U.S. Patent Application Publication No. 2017/0365175.

[10] U.S Patent No. 9,840,312.

[11] U.S. Patent Application Publication No. 2020/0377213.

[12] Innography keyword search for litigations where the patent(s) at issue had an abstract including the word “scuba,” “watercraft,” “boat,” “surf board,” “paddle board,” “wetsuit,” “kayak,” “snorkel,” “wake board,” “swim,” or “personal watercraft,” and excluding “car.” For purposes of clarity, the chart omits certain data for cases unrelated to the water sports industry.

[13] International Swim and Sun Wear Baby Brand, i play., Announces Rebrand to green sprouts, PR Newswire (Jan. 30, 2020), https://www.prnewswire.com/news-releases/international-swim-and-sun-wear-baby-brand-i-play-announces-rebrand-to-green-sprouts-300995368.html; see i play, Inc. v. In Mocean Grp., LLC, 1:17-CV-06659 (S.D.N.Y. Sept. 1, 2017); i play, Inc. v. Shenzhen Adsel Trade Co. Ltd., 1:17-CV-00211 (W.D.N.C. Aug. 2, 2017); i play, Inc. v. In Mocean Grp., LLC, 1:16-CV-00393 (W.D.N.C. Dec. 8, 2016); i play, Inc. v. Jade Swimwear, LP, 1:16-CV-00345 (W.D.N.C. Oct. 21, 2016); i play, Inc. v. Triple 8 Corp., 1:16-CV-00343 (W.D.N.C. Oct. 21, 2016).

[14] See Malibu Boats, LLC v. Go Surf Assist, LLC, 6:20-CV-00552 (W.D. Tex. June 18, 2020); Malibu Boats, LLC v. Skier’s Choice, Inc., 3:19-CV-00225 (E.D. Tenn. June 19, 2019); Malibu Boats, LLC v. Skier’s Choice, Inc., 3:18-CV-00015 (E.D. Tenn. Jan. 12, 2018); Malibu Boats, LLC v. MasterCraft Boat Co. LLC, 3:16-CV-00082 (E.D. Tenn. Feb. 16, 2016); Malibu Boats, LLC v. MasterCraft Boat Co. LLC, 3:15-CV-00276 (E.D. Tenn. June 29, 2015); MasterCraft Boat Co. LLC v. Malibu Boats, LLC, IPR2016-01058 (P.T.A.B. Nov. 16, 2011); MasterCraft Boat Co. LLC v. Malibu Boats, LLC, IPR2016-01057 (P.T.A.B. Nov. 16, 2011).

[15] Complaint at 2, Malibu Boats, LLC v. Go Surf Assist, LLC, 6:20-CV-00552 (W.D. Tex. June 18, 2020).

[16] Andrew Karpan, Jury Wipes Out Wakesurfer’s Patent Claims Against Boat Co., Law360 (May 24, 2021), https://www.law360.com/articles/1386711.

[17] See MHL Custom, Inc. v. Avante Innovations, LLC, 3:20-CV-01648 (S.D. Cal. Aug. 24, 2020) (alleging patent infringement of U.S. Patent Nos. 9,359,044 and 9,586,659); MHL Custom, Inc. v. Waydoo USA, Inc. et al, 1:12-CV-00091 (D. Del. Jan. 27, 2021) (alleging patent infringement U.S. Patent Nos. 9,359,044 and 9,586,659).

[18] Complaint at 3–6, Cayago Tec, GMBH et al v. iAqua Distribution LLC, 0:19-CV-62689 (S.D. Fla. Oct. 29, 2019) (alleging patent infringement of U.S. Patent Nos. 9,694,888 and 9,774,019).

[19] Complaint at 3–4, QBAS Co., Ltd. et al v. Sport Dimensions, Inc. et al, 2:15-CV-07483 (C.D. Cal. Sept. 23, 2015) (alleging patent infringement of U.S. Patent Nos. 6,994,085 and 5,860,168).

[20] Brunswick Completes Acquisition of Freedom Boat Club, Intrado GlobeNewswire (May 20, 2019), https://www.globenewswire.com/news-release/2019/05/21/1840380/0/en/Brunswick-Completes-Acquisition-of-Freedom-Boat-Club.html; Brunswick to Acquire Navico, Navico (Jun. 24, 2021), https://navico.com/2021/06/24/brunswick-to-acquire-navico/.